Tesla Model 3 Tax Credit Check Your Eligibility

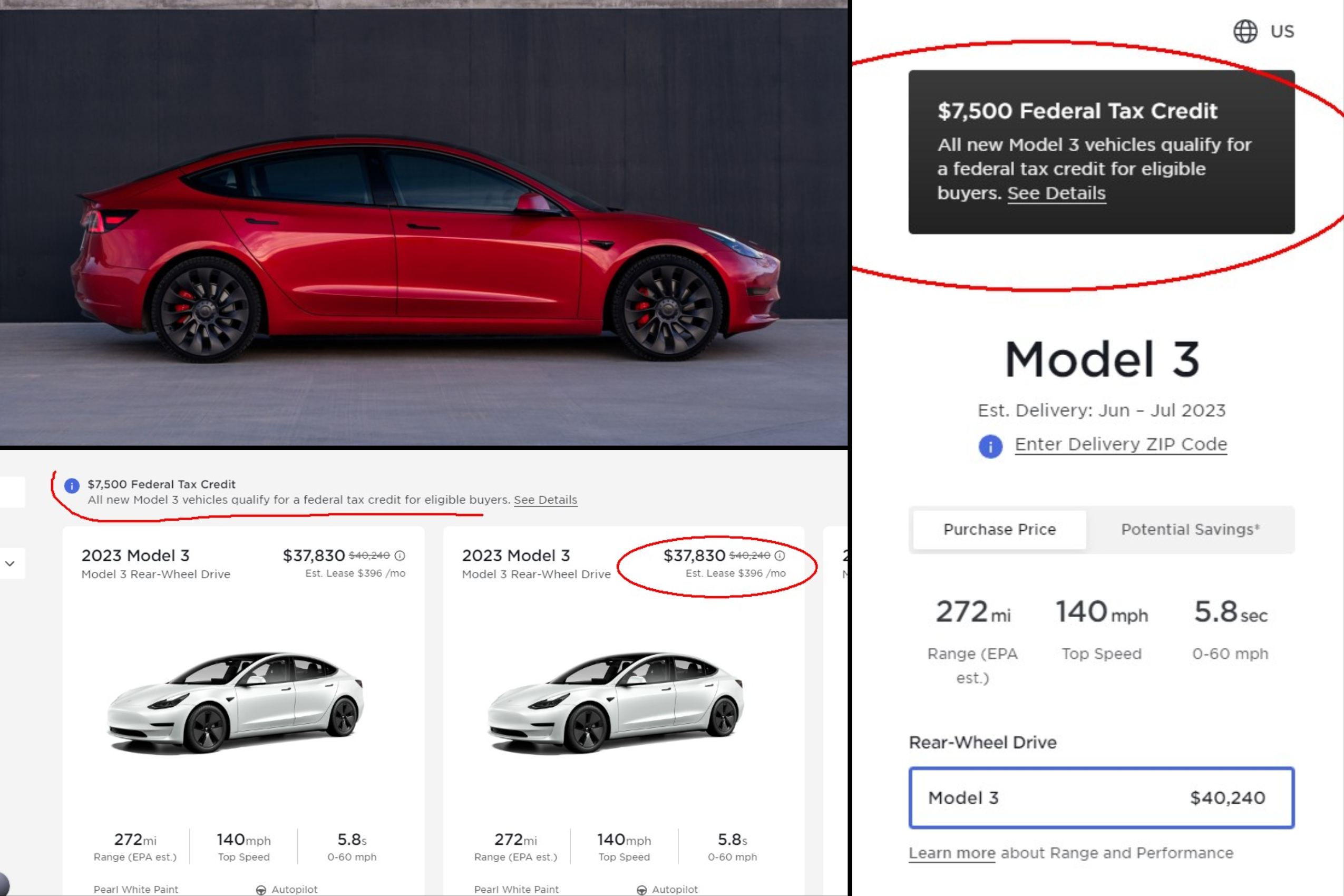

I then asked for refund of my deposit since that makes their website wording misleading. I argued that the writing reads "$7,500 Federal Tax Credit Available for all new Model Y vehicles". Effective yesterday the new point of sale credit is part of the $7,500 federal tax incentive which now can be redeemed in two ways (POS or tax return).

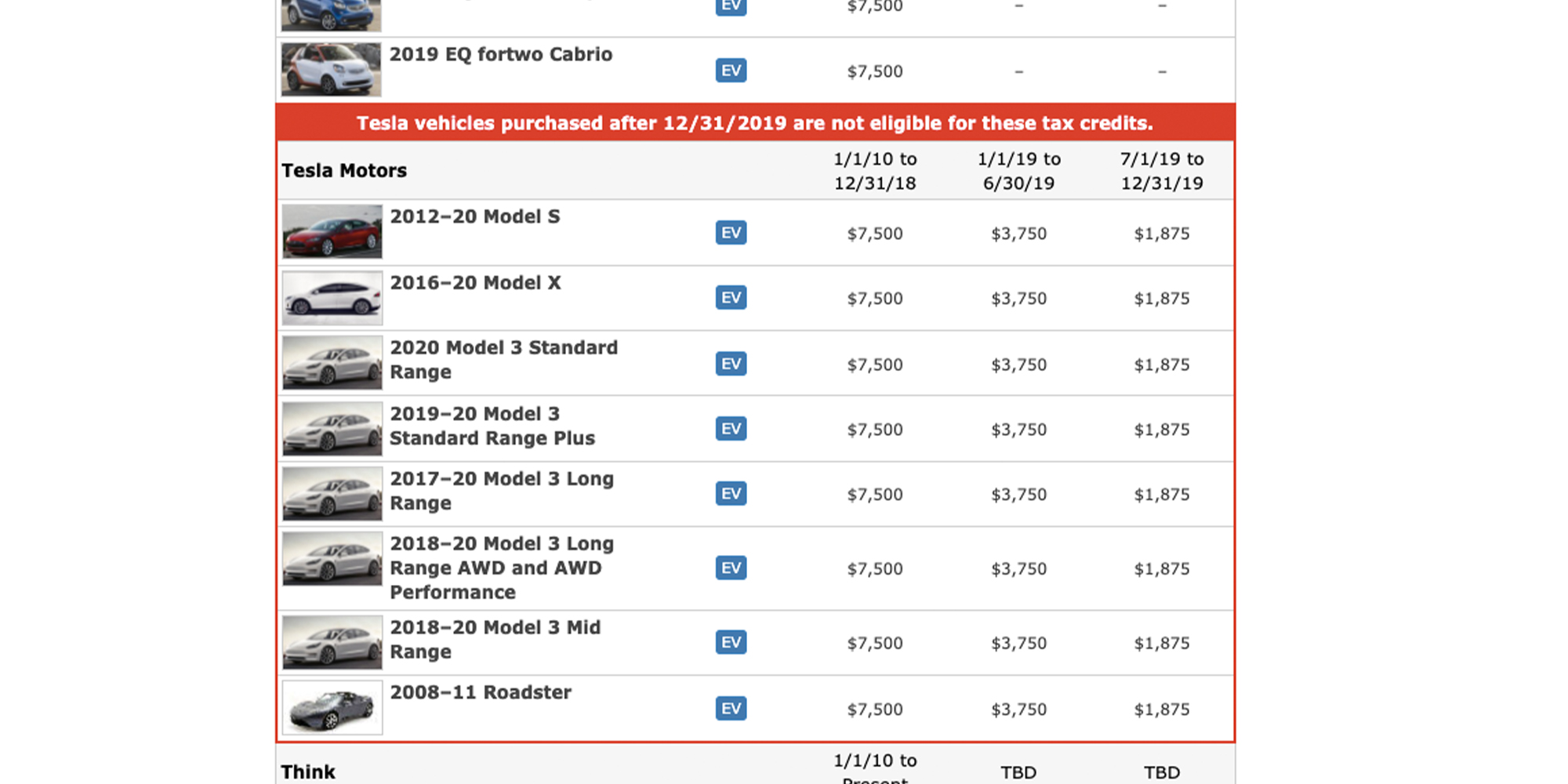

Here are the Tesla models eligible for 7,500 US federal tax credit Electrek

Here's a price breakdown for the 2024 model year, including the requisite flat $1,390 destination charge ($2,245 for Cybertruck), but excluding taxes and applicable tax credits: Tesla model (2024.

Select Tesla Model 3 variants to lose 7,500 tax credit by 2024

Modified adjusted gross income must not exceed $75k for individuals, $112,500 for heads of households, and $150k for joint returns. Additionally, in order for used EV to qualify for federal tax.

Congress passes 1.2 trillion infrastructure bill, 12,500 EV tax credit still awaits passage

The US Treasury's EV charger tax credit (which is claimed on IRS Form 8911) is limited to $1,000 for individuals claiming for home EV charging and $100,000 - up from $30,000 - for business.

Tesla Changed Tactics And Now Displays Prices After Tax Credit

Customers who take delivery of a qualified new Tesla vehicle and meet all federal requirements are eligible for a tax credit up to $7,500, which can be deducted from the purchase price at time of delivery for eligible cash or loan purchases through Tesla. Customers are limited to two time-of-sale tax credits per year. Tax Credit for Each Vehicle:

Tesla confirms hitting federal tax credit threshold, 7,500 credit cut in half at end of 2018

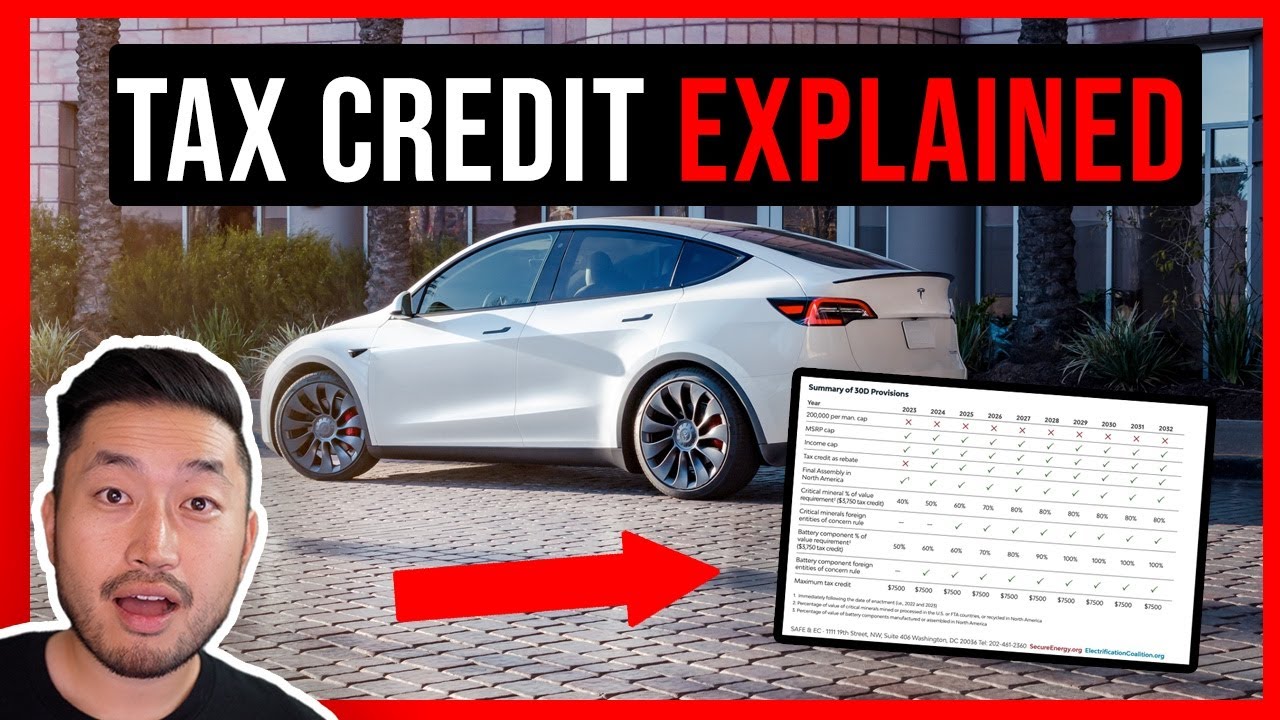

For EV customers, everything changes on January 1, 2024. The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate.

How Tesla Bent IRA Rules To Get Full 7,500 Tax Credit for Model 3 RWD autoevolution

EVsoup / January 7, 2024. From Bearded Tesla Guy. It is officially 2024, and that means that EV Tax Credits for Tesla and others is now eligible for Point Of Sale (POS) transfer. With his major change to the tax code in EV tax credits, 2024 is likely to be the year of the EV. Not only did Tesla once again start qualifying for the EV tax credit.

Tesla Raises Model Y Prices After IRS Made All Trims Qualify for 7,500 Tax Credit autoevolution

To refer a friend: Open the Tesla app. Tap the menu in the top-right corner. Select 'Refer and Earn.'. View the amount of referral credits you will earn and the buyer benefits and exclusive referral benefits your friend will receive for each qualifying Tesla product. Tap 'Refer Now.'.

Tesla's Genius Pricing Plan to Save You Thousands My Tech Methods

Getting the POS tax credit is optional because 26 USC Section 30D(g)(1). Tesla Inc. is an energy + technology company originally from California and currently headquartered in Austin, Texas. Their mission is to accelerate the world's transition to sustainable energy. They produce vertically integrated electric vehicles, batteries, solar, and.

Tesla Tax Credits Are BACK Up To 40,000 YouTube

The $7,500 POS Discount Tax Credit is causing a lot of controversy in the Tesla community. 📱 The IRS is introducing an online portal for sellers to confirm customer eligibility for the incentive.

Tesla Tells US Customers Tax Credit Likely To Decline In 2024 CleanTechnica

BREAKING: Tesla is now officially offering the new $7,500 Fed EV point-of-sale (POS) rebate in the US, enabling an estimated 250 million Americans (up from ~75M in 2023). To get a $7,500 discount.

TESLA EV TAX CREDIT EXPLAINED YouTube

Tesla has also officially updated its website. Tesla is now officially offering the $7,500 EV tax credit as a point of sale rebate in the U.S., for about 250 million Americans. If you want to get.

Tesla Model Y is now eligible for 7,500 IRA tax credit in the US ArenaEV

Today, Tesla officially updated its list of vehicles eligible to the federal tax credit and confirmed that Model Y variants are all retaining access to the full tax credit: Model 3 Performance.

Tesla Warns Model 3 Federal Tax Credit Will "Likely"…

Tesla has embraced the new immediate use of the EV tax credit, which was announced last year by the IRS and Department of the Treasury.. (POS) rebate in the US, enabling an estimated 250.

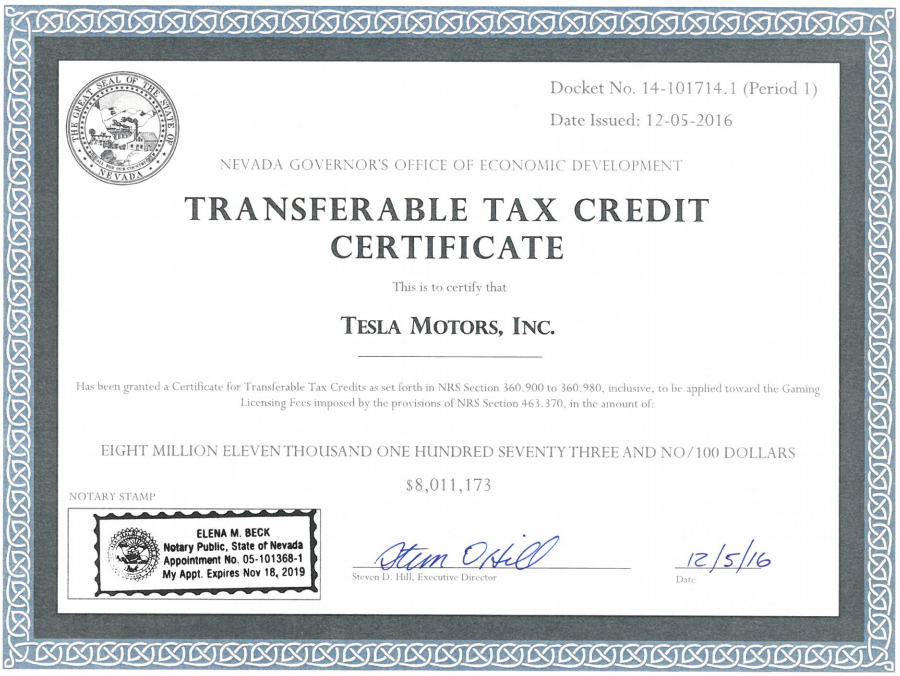

Tesla receives 8 million in tax credit for the Gigafactory after passing audit for job

A $7,500 tax credit for electric vehicles has seen substantial changes in 2024. It should be easier to get because it's now available as an instant rebate at dealerships, but fewer models qualify.

Tesla Warns That 7,500 Tax Credit For Model 3 RWD Will Be Reduced

It is officially 2024, and that means that EV Tax Credits for Tesla and others is now eligible for Point Of Sale (POS) transfer. With his major change to the.